If you're considering starting a business in Nocona, TX, you'll need to understand the significance of the generic license and permit bond. This requirement isn't just a formality; it serves as a safeguard for both you and the community. By securing this bond, you're not only ensuring compliance with local regulations but also enhancing your business's reputation. However, navigating the bond application process can be tricky, and knowing what to expect is crucial. So, what are the key steps you need to take to ensure you're on the right track?

Overview of Nocona

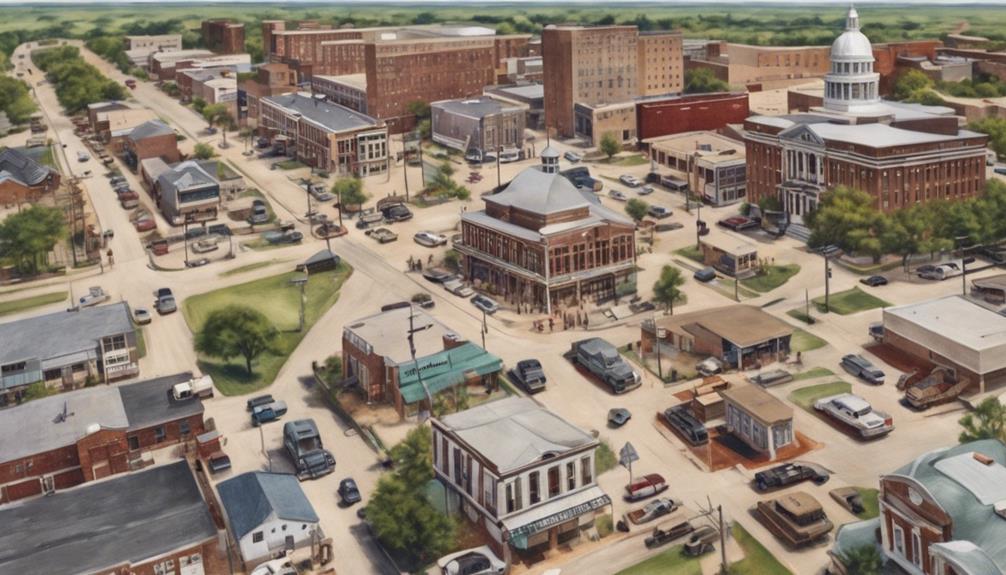

Nestled in the heart of Texas, Nocona offers a unique blend of small-town charm and rich history. As you explore the streets, you'll notice the welcoming atmosphere and the pride of the community in its heritage.

Established in the late 1800s, Nocona has roots that run deep, with its history tied to the cattle industry and boot-making traditions. You can't miss the iconic Nocona Boot Company, showcasing the craftsmanship that has put this town on the map.

Walking through the downtown area, you're likely to encounter friendly locals who are eager to share stories about the town's past. The annual events, like the Nocona Rodeo and the Christmas Parade, reflect the community spirit and provide fun for all ages.

You'll also find beautiful parks and outdoor spaces, perfect for a family picnic or a leisurely stroll.

With its vibrant culture and historical significance, Nocona invites you to experience a slice of Texas life. Whether you're just passing through or considering a longer stay, there's something special about this town that leaves a lasting impression.

Importance of License & Permit Bonds

When starting a business in Nocona, understanding the importance of license and permit bonds is crucial for your success. These bonds serve as a guarantee that you'll comply with local laws and regulations, ensuring that you operate your business ethically and responsibly.

By obtaining a license and permit bond, you're not just following the law; you're also building trust with your customers and the community. This is particularly important because many jurisdictions require specific bond types based on your industry, reflecting the unique risks involved.

Having a bond can protect you from potential financial losses due to non-compliance or misconduct. If a claim arises against your business, the bond can cover damages, which helps maintain your reputation. This added layer of security can be a significant advantage in a competitive market.

Additionally, many clients and partners may require proof of bonding before working with you. This requirement can open doors to more business opportunities, enhancing your credibility.

Types of Bonds Required

In Nocona, various types of bonds are required depending on the nature of your business. These bonds ensure that you comply with local regulations and protect the interests of your clients and the community.

For example, understanding the Michigan Surety Bonds framework can provide valuable insights into the types of bonds that may also apply in other regions.

One common bond is the contractor's license bond, which is essential for construction and renovation projects. This bond guarantees that you'll adhere to building codes and regulations.

If you're operating in the retail sector, a sales tax bond might be necessary to ensure that you'll remit collected sales taxes to the state.

If your business involves handling funds, like in the case of a mortgage broker or a money transmitter, you'll likely need a fidelity bond. This type protects clients from potential fraud or theft by employees.

Additionally, if you're in the auto industry, a motor vehicle dealer bond is required, ensuring compliance with local laws governing vehicle sales.

It's crucial to identify which specific bonds apply to your business to ensure you're fully compliant and protected.

Reviewing local regulations and consulting with a bonding expert can help clarify what you need to obtain before starting your operations in Nocona.

Bond Application Process

The bond application process in Nocona is straightforward, but it requires careful attention to detail.

First, you'll need to gather all necessary documentation, including your business license, identification, and any specific permits related to your project. It's also beneficial to familiarize yourself with the surety bond services available to ensure you understand your options. Make sure you have everything organized before starting the application, as missing documents can delay the process.

Next, you'll fill out the bond application form provided by the bonding agency or your insurance provider. Be honest and accurate in your responses, as discrepancies can lead to complications or denial of your application.

After submitting the form, you may need to provide additional information or clarification, so be prepared to respond promptly.

Once your application is complete, the bonding company will review it, which may involve background checks or verification of your business credentials. This step is crucial, as it helps assess your eligibility for the bond.

Costs Associated With Bonds

After completing the bond application process, understanding the costs associated with bonds is vital for budgeting your project. The primary cost you'll face is the premium, which typically ranges from 1% to 15% of the total bond amount. This premium depends on various factors like your credit score, financial history, and the bonding company's underwriting guidelines.

Additionally, some bond providers may charge an application fee, which can vary based on the provider and the complexity of your bond. It's important to ask about these fees upfront to avoid surprises later.

You should also consider potential renewal costs. Many bonds are valid for a specific term, often one year, and you'll need to renew them periodically. Renewal premiums might differ from the initial premium based on changes in your financial situation or market conditions.

Lastly, remember that you might incur other indirect costs, such as legal fees or administrative expenses, while obtaining and maintaining your bond. By understanding these costs, you can create a realistic budget and ensure your project stays on track financially.

Benefits for Businesses

Securing a license and permit bond can significantly enhance your business's credibility and trustworthiness. When you obtain this bond, you demonstrate to clients and partners that you're committed to adhering to local regulations and operating ethically. This assurance can help you win more contracts and build stronger relationships in your community.

Additionally, having a bond can provide a competitive edge. Many customers prefer working with bonded businesses, as it signifies financial responsibility and reliability. This preference can lead to increased customer loyalty and repeat business, ultimately boosting your revenue.

Moreover, a license and permit bond protects you against potential losses resulting from non-compliance. If a violation occurs, the bond can cover financial damages, preventing significant setbacks for your business.

This safety net allows you to focus on growth and innovation without the constant worry of regulatory issues.

Common Challenges Faced

While the benefits of obtaining a license and permit bond are clear, businesses often encounter several challenges in the process. One common hurdle is understanding the specific requirements set by local authorities. You might find that regulations vary significantly based on your business type and location, leading to confusion about what's needed.

Another challenge lies in the financial aspect. Many businesses struggle to manage the upfront costs associated with obtaining a bond. The premiums can be a strain on your budget, especially for startups or small businesses.

Additionally, the underwriting process can be complicated. Insurers evaluate your business's financial stability and creditworthiness, which might lead to higher rates or even denial for some applicants.

Time constraints can also be an issue. Gathering the necessary documentation and completing the application process can take longer than you expect. Missing deadlines could result in fines or delays in starting your operations.

Resources for Further Information

When you're navigating the process of obtaining a license and permit bond, having access to reliable resources can make all the difference. Start by visiting the official website of the City of Nocona. They often provide specific guidelines, necessary forms, and contact information for local officials who can assist you.

Next, consider reaching out to the Texas Department of Insurance. Their website offers a wealth of information about bonding requirements and regulations throughout the state. You can also find helpful FAQs and downloadable resources that clarify many aspects of the bonding process.

Another valuable resource is the National Association of Surety Bond Producers (NASBP). They provide comprehensive information about surety bonds, including how to choose a reputable bonding company. Networking with professionals in the field can also yield insights and recommendations.

Lastly, don't hesitate to consult local business organizations or chambers of commerce. They often host workshops or informational sessions that can guide you through the licensing and bonding process.

Utilizing these resources will equip you with the knowledge needed to successfully navigate your bond application.

Conclusion

In conclusion, securing a generic license and permit bond in Nocona is essential for your business's success and integrity. Not only does it help you comply with local regulations, but it also builds trust within the community. By investing in this bond, you're not just protecting your business; you're contributing to Nocona's vibrant economy and rich history. Embrace the opportunity to enhance your credibility and foster strong community relationships—it's a win-win for everyone involved!