If you're considering starting a business in El Campo, TX, you'll want to understand the significance of the $3,000 vendor bond. This bond not only reflects your commitment to ethical practices but also plays a crucial role in building trust with your customers and complying with local regulations. By securing this bond, you can enhance your reputation and open doors to better opportunities. However, the process can come with its own set of challenges and requirements that might surprise you. Let's take a closer look at what you need to know.

Overview of Vendor Bonds

Vendor bonds are essential tools for businesses looking to establish trust and credibility in the marketplace. When you engage in vendor activities, these bonds serve as a guarantee that you'll adhere to the rules and regulations set forth by local authorities.

Essentially, a vendor bond protects your customers and the community from potential financial losses resulting from your actions or negligence. Illinois Surety Bonds are particularly important for various industries, ensuring compliance and protecting against financial loss.

By obtaining a vendor bond, you're demonstrating your commitment to ethical business practices. It reassures your clients that you'll fulfill your contractual obligations, whether it's delivering goods on time or providing quality services.

If you fail to meet these standards, your bond can be claimed against, providing compensation to affected parties.

Furthermore, having a vendor bond can enhance your reputation, making it easier to attract clients and secure contracts. It differentiates you from competitors who may not have the same level of accountability.

In short, vendor bonds aren't just a formality; they're vital for your business's long-term success. They help you build a solid foundation of trust, essential for fostering positive relationships with customers, suppliers, and the community as a whole.

Importance of the ,000 Bond

A $3,000 bond plays a crucial role in ensuring compliance and trustworthiness in El Campo, TX. By securing this bond, you're not only following legal requirements but also demonstrating your commitment to ethical business practices.

This bond protects consumers and the community, ensuring that you'll uphold your obligations as a vendor. Additionally, obtaining a bond can enhance your credibility, similar to how debt consolidator bonds protect consumers from unethical behaviors in financial services.

When you obtain a $3,000 bond, you're effectively vouching for your reliability. If you fail to meet your contractual obligations, the bond provides a financial safety net for your clients, allowing them to recover losses. This builds trust between you and your customers, enhancing your reputation in the marketplace.

Moreover, having a bond can give you a competitive edge. Many clients prefer working with bonded vendors, knowing that they're protected. It signals professionalism and a dedication to quality service.

Additionally, bonding can help you access better business opportunities, as some contracts only go to vendors who can demonstrate their financial responsibility through bonding.

Eligibility Requirements

To qualify for the $3,000 bond in El Campo, TX, you'll need to meet several specific eligibility requirements.

First, you must be a legal resident of Texas or have a business entity registered in the state. This ensures that you're familiar with local regulations and business practices. Additionally, understanding the types of bonds required for your industry can be beneficial, such as those related to Louisiana Surety Bonds for similar compliance needs.

Next, you should have a clean financial background. This typically means having no recent bankruptcies or significant tax liens. Insurers often check your credit history, so maintaining a good credit score will strengthen your application.

Additionally, you'll need to provide proof of your business operations, which usually includes a valid business license specific to El Campo.

You might also be required to demonstrate experience in your trade or industry. This helps assure the surety company that you're capable of fulfilling your contractual obligations.

Lastly, some surety companies may ask for personal or business references, so be prepared to provide those if necessary.

Application Process

Once you've ensured you meet the eligibility requirements, the application process for the $3,000 bond in El Campo, TX, is straightforward.

First, you'll need to find a licensed surety bond provider. Research local agents or companies to find one that specializes in vendor bonds. Contact them to express your interest and request an application.

Next, you'll fill out the application form, which typically asks for basic personal information, business details, and your financial background. Be honest and thorough in your responses to avoid delays.

Once you've submitted your application, the surety will evaluate your information, which may include a credit check and a review of your business history.

After the evaluation, if everything checks out, you'll receive a quote for the bond premium. Once you agree to the terms, you'll pay the premium, and the surety will issue the bond.

Required Documentation

When applying for the vendor bond in El Campo, TX, you'll need to gather several key documents to support your application.

First, prepare a completed bond application form, which outlines your business details and the type of goods or services you'll provide. You'll also need to provide a copy of your business license or permit, showing that you're legally authorized to operate in the area.

Additionally, you should collect financial statements, such as bank statements or profit and loss statements, to demonstrate your financial stability. These documents help the bonding company assess your ability to fulfill your obligations.

If you've had previous experience in your field, including references or letters of recommendation can strengthen your application.

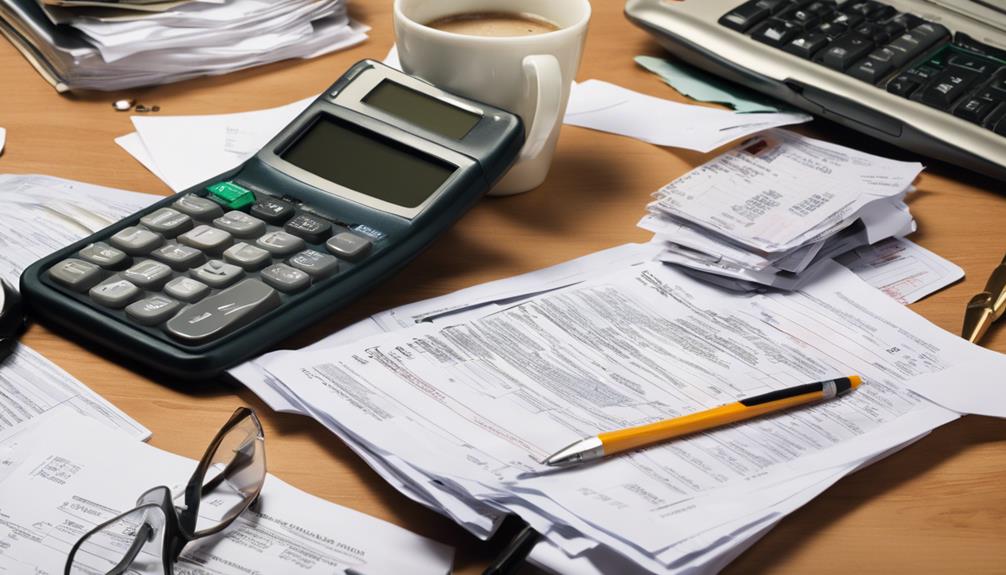

Bond Costs and Fees

Understanding bond costs and fees is crucial for anyone looking to secure a vendor bond in El Campo, TX. The cost of a vendor bond typically depends on several factors, including your credit score, the bond amount, and the underwriting process used by the bonding company.

Generally, you can expect to pay a percentage of the total bond amount, usually ranging from 1% to 15%. For a $3,000 vendor bond, if you're in good standing with your credit, you might pay as little as $30 to $450. However, if your credit needs improvement, costs could rise significantly.

It's essential to shop around and compare quotes from different bonding companies to find the best rates. Additionally, you may encounter other fees, such as application fees or service charges, which can vary by provider.

Make sure to read the fine print so you're aware of all potential costs before committing. Remember, securing a vendor bond is an investment in your business, so understanding the associated costs will help you budget effectively and ensure compliance with local regulations.

Duration and Renewal

After you've navigated the costs and fees associated with securing a vendor bond, it's important to know how long that bond will remain valid and what the renewal process entails.

Generally, a vendor bond in El Campo, TX, is valid for one year from the date of issue. This means you'll need to keep track of the expiration date to ensure you maintain compliance with local regulations.

As your bond approaches its expiration, you'll need to initiate the renewal process. This typically involves contacting your surety company to discuss your renewal options. They may require you to provide updated information, such as financial statements or any changes in your business structure.

Depending on your circumstances, your premium might change, so be prepared for a possible adjustment.

It's crucial to renew your bond before it expires to avoid any lapses in coverage. A lapse could lead to fines or even suspension of your vendor's license.

Common Challenges

Securing a vendor bond in El Campo, TX, can come with its share of challenges that you need to navigate effectively. One common hurdle is understanding the specific requirements set by the state. Different types of bonds have varying regulations, and missing a detail could delay your application.

Another challenge is the financial aspect. You'll need to demonstrate your creditworthiness, and if your credit score isn't ideal, you might face higher premiums. This can strain your budget, especially if you're just starting your business.

Additionally, the bond application process can be time-consuming. Gathering necessary documentation, such as business licenses and financial statements, can feel overwhelming, particularly if you're unfamiliar with the requirements.

You may also encounter difficulties in finding a reliable surety company willing to issue your bond. Not all companies provide vendor bonds, and those that do may have strict criteria.

Benefits for Vendors

A vendor bond in El Campo, TX, offers you peace of mind and builds trust with your clients. By securing this bond, you demonstrate your commitment to operating ethically and in compliance with local regulations. This can enhance your reputation and help you stand out in a competitive market.

When clients see that you have a vendor bond, they feel more secure in their decision to work with you. It assures them that you're financially responsible and that their interests are protected. Should any disputes arise, the bond can provide a safety net, allowing clients to file a claim if you fail to meet your obligations.

Additionally, having a vendor bond can open up more business opportunities. Many clients, especially larger companies or government contracts, require vendors to be bonded as part of their hiring criteria.

Being bonded can give you a competitive edge and increase your chances of landing lucrative contracts.

Community Impact

Having a vendor bond in El Campo, TX, not only benefits your business but also positively impacts the community. When you obtain a vendor bond, you're demonstrating your commitment to ethical business practices. This builds trust among your customers, which in turn fosters a stronger community. People feel more secure purchasing goods and services from vendors who are bonded, knowing there's a safety net in place should any issues arise.

Additionally, your bond contributes to local economic stability. By ensuring that you operate within the law and meet all regulations, you help maintain a fair market. This encourages other vendors to follow suit, promoting a sense of accountability that can elevate the entire business environment in El Campo.

Moreover, your bond may support local initiatives and projects. Many bonding companies contribute to community programs, creating a ripple effect that benefits everyone. Your participation in this system strengthens the local economy, paving the way for growth and development.

Ultimately, having a vendor bond isn't just a requirement; it's a way for you to invest in your community's future, ensuring that El Campo remains a vibrant and thriving place to live and do business.

Conclusion

In conclusion, obtaining a $3,000 vendor bond in El Campo, TX, is a smart move for your business. Not only does it help you comply with local regulations, but it also boosts your credibility and attracts more clients. By showing your commitment to ethical practices, you enhance your reputation and contribute to a trustworthy community. So, take the steps necessary to secure your bond and enjoy the benefits that come with being a reliable vendor.