If you're considering hiring a contractor in Beaumont, TX, you might want to understand the importance of a Building Contractor Bond. This bond isn't just a formality; it's a crucial safeguard for both you and the contractor, ensuring that projects are completed as promised and in compliance with local regulations. You might wonder what specific requirements contractors must meet to obtain this bond, and how it ultimately benefits you as a homeowner. The nuances of this process could surprise you—so let's explore what you need to know.

Understanding Building Contractor Bonds

A building contractor bond is essential for ensuring that contractors operate ethically and responsibly. This bond acts as a safety net, protecting you and your clients from potential financial losses caused by a contractor's failure to meet contractual obligations.

When you hire a bonded contractor, you can rest easy knowing they've been vetted and are held accountable for their work. In Michigan, for instance, these bonds are governed by state laws and are often required for various construction projects to ensure compliance with local regulations and standards, making them a crucial part of the industry Michigan Surety Bonds.

Understanding the components of a building contractor bond is crucial. The bond typically involves three parties: the contractor, the obligee (you or the client), and the surety company that issues the bond. If the contractor fails to complete the job or violates any terms, you can file a claim against the bond. The surety then investigates the claim and compensates you if valid.

Moreover, the bond reflects a contractor's professionalism and reliability. It shows they're committed to adhering to local regulations and industry standards.

Importance of Contractor Bonds

Many homeowners and businesses don't realize the critical role contractor bonds play in the construction industry. These bonds act as a safety net for you, ensuring that your project is completed according to the agreed-upon terms.

When you hire a bonded contractor, you're protecting yourself from potential financial losses due to unfinished work, substandard materials, or violations of local codes. In Texas, different types of contractor bonds are required for various trades, such as the Brazos County, TX: Superheavy or Oversize Permit Bond.

Contractor bonds also promote accountability. If a contractor fails to meet their obligations, you have the right to file a claim against their bond. This process gives you a way to seek compensation for any damages or losses you might incur. Moreover, it encourages contractors to adhere to industry standards and regulations, knowing their reputation is on the line.

Additionally, having a contractor bond can enhance your trust in the professional you're hiring. It signals that they've met certain requirements and are committed to ethical practices.

In a nutshell, contractor bonds not only safeguard your investment but also foster a more reliable and professional construction environment. So, when you're embarking on a project, make sure to prioritize hiring a bonded contractor for your peace of mind.

Requirements for Beaumont Contractors

Before hiring a contractor in Beaumont, it's essential to understand the specific requirements they must meet to operate legally. First, contractors need to obtain the appropriate licenses. In Beaumont, this typically means holding a general contractor's license or a specialized license for specific trades, such as plumbing or electrical work.

Additionally, contractors must provide proof of insurance, including liability and workers' compensation coverage. This is crucial to protect you and their employees from any accidents or damages that may occur during the project. Furthermore, contractors should have a valid building contractor bond, which ensures compliance with local regulations and protects consumers from potential financial harm due to contractor negligence or fraud, similar to how used car dealer bonds provide consumer protection in the auto sales industry.

Next, your contractor should have a valid building contractor bond. This bond acts as a safeguard for both you and the city, ensuring that the contractor adheres to local regulations and fulfills their obligations.

It's also wise to check if the contractor has any previous complaints or disciplinary actions against them. You can often find this information through the Better Business Bureau or local licensing boards.

Lastly, make sure the contractor has experience in your specific type of project. This ensures they understand the nuances of your job and can deliver quality work. By following these steps, you'll be well-prepared to choose a qualified contractor in Beaumont.

Application Process for Bonds

Navigating the application process for a building contractor bond in Beaumont can seem daunting, but understanding the steps involved makes it manageable.

First, you'll need to gather necessary documents, such as your business license, proof of insurance, and any required financial statements. This information helps demonstrate your credibility and financial stability.

Next, contact a surety bond provider or agent. They'll guide you through the application and assess your qualifications. Be prepared to answer questions about your work experience, business practices, and any past projects. The provider will evaluate your application based on these factors.

Once you submit your application, the surety company will conduct a background check, which typically includes your credit history and financial standing. This process could take a few days, so patience is key.

Upon approval, you'll receive a quote for the bond premium. Don't hesitate to compare quotes from different providers to ensure you're getting the best deal.

After you accept the terms, you'll pay the premium, and the bond will be issued. With your bond in hand, you're all set to operate as a licensed contractor in Beaumont!

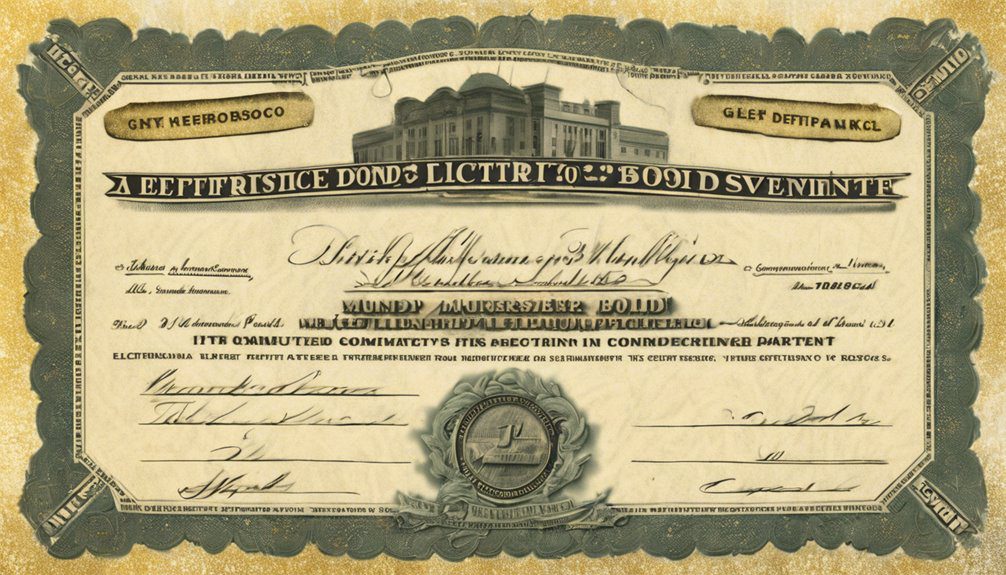

Types of Contractor Bonds

Once you've secured your building contractor bond, it's important to understand the various types of contractor bonds available. Each bond serves a specific purpose and helps protect different parties involved in a construction project.

First, you have the performance bond, which ensures that you'll complete the project according to the contract's terms. If you fail to meet these requirements, the bond covers the costs to complete the work.

Next is the payment bond, which guarantees that you'll pay your subcontractors and suppliers. This bond protects them from not receiving payment for their services, ensuring that everyone involved gets compensated.

Another type is the license bond. This bond is often required by the state or local government to ensure you adhere to regulations and laws governing your profession. It's a way to prove your legitimacy as a contractor.

Lastly, there's the bid bond, which assures that you'll enter into a contract if you win the bid. If you back out, the bond compensates the project owner for any losses incurred.

Understanding these bonds will help you navigate the construction landscape effectively.

Benefits for Homeowners

Homeowners can benefit significantly from contractor bonds, as these financial safeguards offer peace of mind throughout the construction process. When you hire a bonded contractor, you're ensuring that they're financially responsible and have met specific licensing requirements. This connection helps you feel secure knowing that your investment is protected.

One of the main advantages is that if the contractor fails to complete the project or doesn't adhere to local regulations, the bond can provide compensation for any losses you may suffer. This financial protection can be crucial, as it reduces the risk of losing your hard-earned money due to contractor negligence.

Additionally, working with a bonded contractor often means you're dealing with a professional who values their reputation. They're more likely to meet deadlines, maintain high-quality workmanship, and communicate effectively throughout the project. This commitment to excellence can lead to a smoother construction experience.

In short, contractor bonds not only protect your financial investment but also promote accountability and professionalism in the construction industry. By choosing a bonded contractor, you're making a smart move for your home improvement or construction project.

Common Challenges and Solutions

While working with contractors can be rewarding, it's not without its common challenges that can arise during a project. One major issue is communication breakdown. Misunderstandings can lead to delays and costly mistakes. To tackle this, establish clear communication channels and set regular check-in meetings to ensure everyone's on the same page.

Another challenge is budget overruns. It's easy for costs to spiral if you don't monitor expenses closely. To prevent this, create a detailed budget before starting the project and track your spending throughout. If unexpected costs arise, address them immediately to avoid larger issues later.

Scheduling conflicts can also hinder progress. Contractors might have multiple projects, causing delays in your timeline. To counteract this, discuss timelines upfront and build in buffer time for unexpected delays.

Lastly, you might face quality concerns. If the work doesn't meet your expectations, it can be frustrating. To avoid this, do your research and choose contractors with solid reputations. Don't hesitate to ask for references and review past work.

Conclusion

In conclusion, obtaining a Building Contractor Bond in Beaumont, TX, is crucial for both contractors and homeowners. It not only ensures compliance with local laws but also protects you from potential financial losses. By understanding the application process and types of bonds available, you can make informed decisions. Embracing this requirement fosters a trustworthy construction environment, giving you confidence in your contractor's commitment to professionalism and accountability throughout your project.