If you're considering starting a business in Nacogdoches, TX, you'll need to understand the significance of the Generic License & Permit Bond. This bond isn't just a formality; it's an essential step that ensures your compliance with local regulations and builds trust with your customers. By securing this bond, you're not only protecting your interests but also contributing positively to the community. However, the process and requirements can be a bit complex, and you might wonder what challenges you could face along the way. Let's explore those details further.

Overview of Nacogdoches

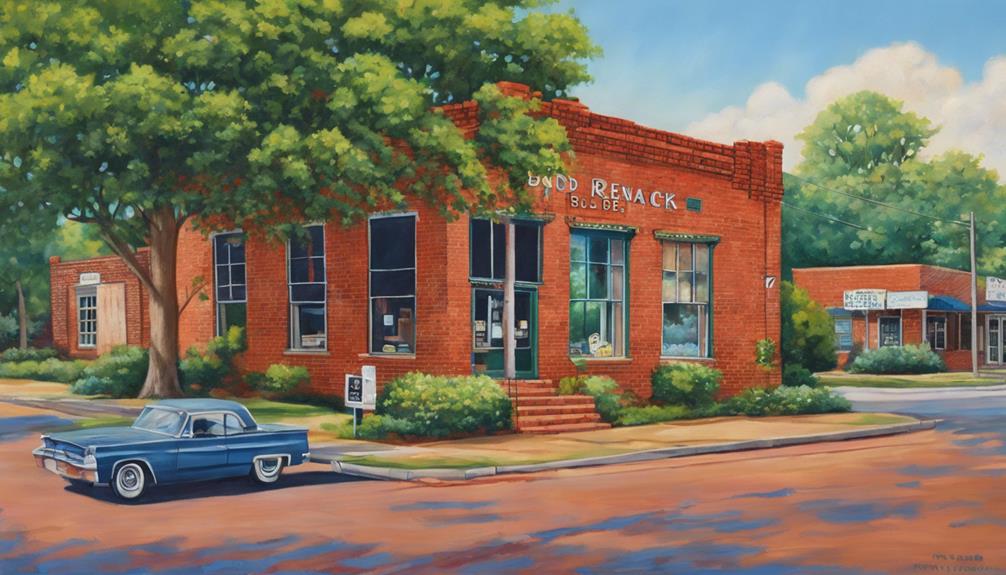

Nacogdoches, often called the oldest town in Texas, boasts a rich history and vibrant culture that captivates residents and visitors alike. As you stroll through its charming streets, you'll find a unique blend of historical landmarks and modern amenities.

The town's deep roots trace back to Native American tribes, and remnants of its past can be seen in sites like the historic Nacogdoches Mission and the Texas Flag Park.

You'll enjoy the colorful festivals held throughout the year, showcasing local art, music, and food. The annual Nacogdoches Blueberry Festival is a highlight, drawing crowds eager to sample fresh blueberry treats and enjoy live entertainment.

Nature lovers will appreciate the nearby parks, such as the beautiful Millard's Crossing Historic Village and the lush Piney Woods surrounding the area. Whether you're hiking, shopping, or dining, there's something for everyone in this welcoming community.

Nacogdoches also prides itself on its commitment to education, home to Stephen F. Austin State University, which adds a youthful energy to the town.

With its friendly atmosphere and historical significance, you can't help but feel the charm of Nacogdoches during your visit.

Importance of License Bonds

In a community as vibrant as Nacogdoches, business owners must understand the role of license bonds in ensuring a trustworthy environment. License bonds serve as a guarantee to protect consumers, ensuring that businesses comply with local regulations and ethical standards, which is essential for fostering community trust.

When you obtain a license bond, you're essentially committing to uphold local regulations and standards, which fosters trust between you and your customers. By securing a license bond, you not only show your dedication to compliance but also provide a safety net for your clients. If you were to fail in meeting your obligations, the bond can cover financial losses incurred by your customers, giving them peace of mind when they choose to do business with you. This assurance often translates to a competitive edge in the marketplace.

Moreover, having a license bond can enhance your business's reputation. It demonstrates your professionalism and responsibility, attracting more clients who value trustworthiness.

Types of Bonds in Nacogdoches

When it comes to operating a business in Nacogdoches, understanding the various types of bonds available is essential. License and permit bonds are the most common, as they ensure that you comply with local regulations.

These bonds protect the city and its residents by guaranteeing that you'll follow the law when conducting your business. Additionally, these bonds act as financial protection for the public against potential business malpractice, holding you accountable for your operations.

Another type you might encounter is a performance bond. This bond assures that you'll complete a project according to the contract terms. If you fail to do so, the bond provides compensation to the project owner.

Similarly, a payment bond ensures that subcontractors and suppliers get paid for their work, protecting them from financial loss.

You should also be aware of contractor bonds, which may be required for specific trades. These bonds guarantee that your work meets licensing standards and local codes. If you're in the construction industry, this bond is particularly important.

Lastly, there are custom bonds tailored for specific industries or situations. Understanding these various types will help you choose the right bond for your business needs and ensure compliance with local regulations.

Application Process for Bonds

Understanding the application process for bonds is key to ensuring your business meets local requirements. To start, you'll need to gather the necessary documentation. This typically includes your business license, financial statements, and any relevant personal information. Make sure all your documents are current and accurately reflect your business's status.

Additionally, ensure compliance with state regulations, as this is critical for the approval of your bond application, especially for those in regulated industries like construction surety bond requirements.

Next, you'll want to choose a reliable surety company. Research different providers to find one that specializes in license and permit bonds. It's essential to compare rates, terms, and customer reviews to ensure you're getting the best deal.

Once you've selected a surety provider, you'll fill out an application. This usually involves providing details about your business and its owners. Be prepared to answer questions regarding your financial history and business practices, as this information helps the surety assess your risk level.

After submitting your application, the surety will review your information and may request additional documentation. If approved, you'll receive a quote for your bond premium. Once you agree to the terms and pay, you'll get your bond, allowing you to operate legally within Nacogdoches.

Requirements for Obtaining a Bond

To obtain a bond for your business in Nacogdoches, you'll need to meet several key requirements. First, you'll want to ensure that your business is properly registered and licensed according to local regulations. This includes having the appropriate permits that align with your specific industry.

It's also important to consider the specific type of bond required, as different bonds serve distinct purposes and cater to various industries, such as Missouri Surety Bonds.

Next, you'll need to provide financial documentation to demonstrate your business's stability. This often includes tax returns, bank statements, and profit-loss statements. Insurers want to see that you can fulfill any obligations tied to the bond.

Additionally, you'll likely undergo a background check. This helps the bonding company assess your creditworthiness and history. A strong credit score can significantly improve your chances of securing a bond.

You'll also need to specify the type of bond you require, as there are various categories based on your business activities.

Lastly, prepare to fill out an application form detailing your business's operations, ownership, and any previous bonding experience. By gathering all necessary documents and information, you can streamline the bond acquisition process and ensure compliance with Nacogdoches regulations.

Costs Associated With Bonds

After securing your bond, it's important to be aware of the costs associated with it. The primary expense you'll face is the premium, which is typically a percentage of the bond amount. This percentage can vary based on factors like your credit score, the bond type, and the bond amount required. Generally, you can expect premiums to range from 1% to 10% of the total bond value.

In addition to the premium, there may be other fees involved. Some bond providers charge processing fees, which can add to your overall costs. It's crucial to read the fine print and understand any additional charges that may apply.

You should also consider the possibility of collateral requirements. Some surety companies may ask for collateral to back the bond, especially if your credit isn't strong. This could tie up some of your funds until the bond is released.

Lastly, don't forget about potential renewal fees if your bond needs to be renewed periodically. Make sure to budget for these ongoing costs to avoid surprises down the line. Understanding these expenses will help you plan your finances effectively.

Bond Renewal Procedures

How do you ensure your bond remains valid? To keep your license and permit bond in good standing, you'll need to renew it before it expires.

Begin by checking the expiration date on your current bond; this will give you a timeline for renewal.

Contact your surety bond provider a few weeks in advance to initiate the renewal process. They might require updated information about your business operations, financial statements, or any changes in your personal circumstances.

Be prepared to provide this information promptly to avoid any delays.

Once your application is processed, you'll receive a new bond document. Review it carefully to ensure all details are accurate, including the coverage amount and your business information.

After confirming everything is correct, make sure to pay any renewal fees associated with the bond.

Keep a copy of your renewed bond on file, and submit it to the relevant city office if required.

Common Challenges Faced

While navigating the process of obtaining and maintaining a license and permit bond in Nacogdoches, you may encounter several common challenges. One major hurdle is understanding the specific requirements set by the city. Each type of license or permit may have different bonding requirements, and it can be confusing to ensure you're meeting them all.

Another challenge is finding a reputable bonding company. Not all companies offer the same services or rates, so it's crucial to do your research. You might face issues with paperwork, too. Missing documents or incomplete applications can delay your bonding process and lead to frustration.

Additionally, financial qualifications can be a roadblock. If you don't meet the financial requirements, securing the bond may take longer than anticipated.

Lastly, keeping track of expiration dates and renewal procedures can be overwhelming. It's easy to lose track, but failing to renew on time could put you at risk of penalties or even losing your license.

Being aware of these challenges can help you prepare better and streamline the bond application process in Nacogdoches.

Benefits for Businesses

Businesses in Nacogdoches often find that obtaining a license and permit bond offers significant advantages. First, it demonstrates your commitment to operating legally and ethically. This bond acts as a safety net, ensuring that you comply with local regulations.

Being bonded can enhance your credibility with clients and customers, making them more likely to trust your business.

Additionally, having a license and permit bond can help you secure contracts more easily. Many clients prefer working with bonded companies, as it provides them with assurance that you'll fulfill your obligations. This competitive edge can lead to increased business opportunities.

Another advantage is the financial protection a bond offers. If you fail to meet your contractual obligations, the bond can cover any resulting claims, reducing your financial risk.

This security can be particularly advantageous in industries where compliance issues may arise.

Resources for Business Owners

Navigating the complexities of starting and running a business in Nacogdoches can be overwhelming, but utilizing available resources can make the process smoother.

Start by connecting with the Nacogdoches Economic Development Corporation (NEDC). They offer valuable support, from guidance on permits to financial incentives that can help your business thrive.

You should also consider joining the Nacogdoches Chamber of Commerce. They provide networking opportunities, workshops, and access to local business resources that can help you grow.

Don't overlook the Small Business Development Center (SBDC) at Stephen F. Austin State University. The SBDC offers free business consulting and training programs tailored to your needs.

Local banks and credit unions can also be essential partners for securing financing. Building a relationship with a local lender can provide you with tailored financial solutions.

Conclusion

In conclusion, obtaining a Generic License & Permit Bond in Nacogdoches is essential for your business's success and reputation. Not only does it ensure compliance with local regulations, but it also builds trust with your clients. By navigating the application process and meeting the requirements, you're taking a proactive step toward a thriving business in this historic city. Embrace the benefits of the bond, and watch your company flourish in the Nacogdoches community.