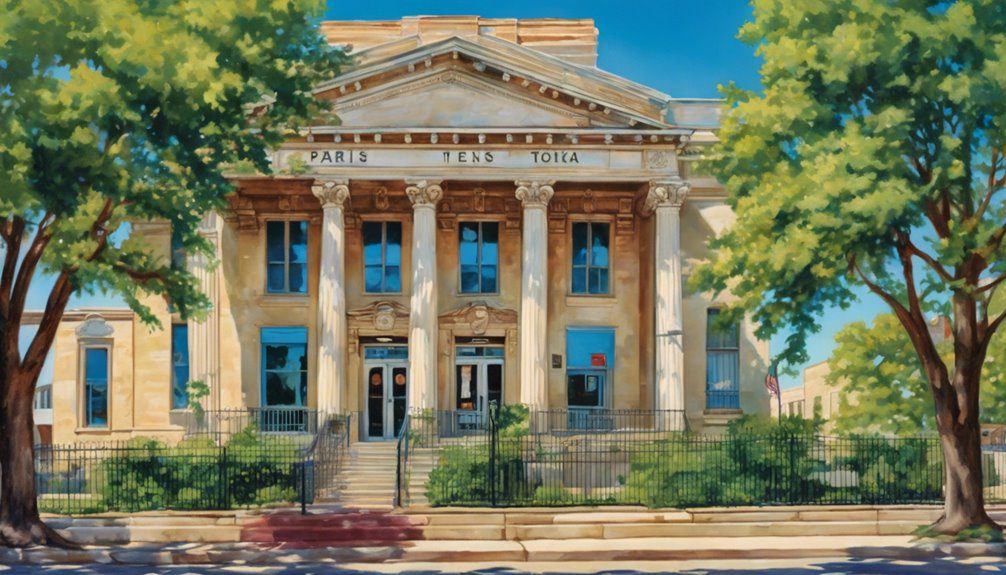

When you're considering starting a business in Paris, Texas, understanding the role of the Generic License & Permit Bond is essential. This bond not only protects public interests but also assures your clients that you're committed to following local regulations. You might wonder what types of licenses require this bond and how to navigate the process of obtaining one. As you explore the specifics, you'll find that the costs and requirements can vary significantly, raising questions about compliance and potential challenges ahead. What could that mean for your business?

Understanding License and Permit Bonds

Understanding license and permit bonds is crucial for anyone looking to operate a business in the City of Paris. These bonds serve as a guarantee that you'll comply with local laws and regulations.

When you obtain a license or permit, you're essentially promising to adhere to the rules set by the city. If you fail to do so, the bond protects the public by providing a financial safety net.

When you apply for a license or permit, you'll typically need to secure a bond. This process involves paying a premium, which is usually a fraction of the bond amount.

The bond amount varies based on the type of business you plan to run and the specific requirements of the city. Additionally, securing appropriate surety bonds is often a prerequisite for obtaining a business license.

Importance of Generic Bonds

While many people overlook the significance of generic bonds, they play a vital role in business operations and financial security. These bonds act as a safety net, ensuring that you comply with local regulations and safeguarding your business against potential risks. When you secure a generic bond, you demonstrate your commitment to meeting legal requirements, which can enhance your reputation in the community.

Generic bonds also help you establish trust with clients and partners. They signal that you're financially responsible and serious about your business commitments. If a dispute arises, the bond can provide financial compensation, alleviating concerns for both parties. This assurance can be a deciding factor for customers when choosing between you and competitors.

Moreover, generic bonds can lead to more opportunities. Many municipalities require them for obtaining permits and licenses, so having one can open doors for projects that might otherwise be out of reach. Florida Surety Bonds are particularly essential for ensuring compliance with state regulations, further solidifying your business's credibility.

As you navigate the complexities of running a business, don't underestimate the importance of generic bonds. They not only protect you but also contribute to your overall business growth and stability. Embracing this financial tool can set you on the path to success.

Types of Licenses and Permits

What types of licenses and permits do you need to operate legally in your city?

In Paris, Texas, various licenses and permits are essential, depending on your business activities. If you're running a restaurant, you'll need a food service permit and possibly a liquor license.

For construction or renovation projects, a building permit is crucial to ensure compliance with local regulations.

If you're starting a retail business, a sales tax permit is necessary to collect sales tax from customers.

Home-based businesses may require a home occupation permit, while any business employing staff will need to register for an employer identification number (EIN).

Additionally, specific professions, like plumbers or electricians, might require individual professional licenses.

You should also check for any zoning permits that may apply to your business location. Furthermore, businesses engaging in money transmission activities may also need to secure money transmitter bonds to comply with regulatory requirements.

Steps to Obtain a Bond

Obtaining a bond for your business is a straightforward process that involves several key steps.

First, you'll need to determine the specific type of bond required for your license or permit. Research the regulations in Paris, TX, to make sure you comply.

Next, gather the necessary documentation, which typically includes your business information, financial statements, and any other paperwork required by the bonding company. Having this information ready will streamline the application process.

Once you have your documents in order, reach out to a surety bond provider. You can compare quotes from different companies to find one that suits your needs.

After selecting a provider, fill out their application, providing all requested information accurately.

After you submit your application, the bonding company will assess your financial stability and business history. They may ask for additional information or clarification during this process.

Once approved, you'll receive your bond and can pay any applicable fees. It's also important to understand the types of surety bonds required in your state to ensure compliance with local regulations.

Costs Involved in Bonding

After you've secured your bond, it's important to consider the costs involved. The total expense can vary significantly based on several factors, including the bond amount, your credit score, and the specific requirements set by the City of Paris.

Typically, you'll pay a premium, which is a percentage of the total bond amount, often ranging from 1% to 15%. If you have a solid credit score, you may qualify for a lower premium, while a lower score could hike the rate.

Additionally, some bonding companies might charge administrative fees, which can add to your overall costs. It's wise to shop around and compare quotes from different providers to find the best deal.

Keep in mind that while the upfront costs are essential, you should also consider the long-term implications of your bond. Regular renewals might be necessary, and understanding these ongoing expenses will help you budget accordingly.

Moreover, working with an experienced bonding team can streamline the bonding process and potentially reduce your costs through in-house underwriting authority for quick approval.

In short, when planning your budget for a license and permit bond, factor in not just the premium but also any additional fees to get a complete picture of your financial commitment.

Common Challenges Faced

Navigating the process of securing a license and permit bond can present several challenges that you mightn't anticipate. One of the main hurdles is understanding the specific requirements for your industry. Every business type has different regulations, and failing to grasp these can lead to delays or denials in obtaining your bond.

You may also face difficulty in gathering the necessary documentation. Insufficient paperwork can stall your application process, so it's crucial to organize everything beforehand.

Additionally, bonding companies often require a thorough credit check. If your credit score isn't strong, you might either face higher premium rates or find it challenging to secure a bond at all.

Another common issue is the timeline. Many businesses underestimate how long it takes to process bond applications. This can be particularly frustrating if you're on a tight schedule to meet project deadlines. Furthermore, it's important to remember that compliance with local laws is essential for businesses seeking to avoid penalties or delays in bond issuance.

Maintaining Compliance and Renewal

Maintaining compliance with your license and permit bond is crucial for the smooth operation of your business. To stay compliant, you need to keep track of all requirements set by the City of Paris, Texas. This includes adhering to local regulations, ensuring all necessary documentation is up to date, and following any changes in laws that may affect your industry.

Renewal of your bond is another vital aspect. Most bonds require annual renewal, so don't let the deadlines catch you off guard. Set reminders well in advance to avoid lapsing on your bond, which can lead to penalties or even business interruption. It's also a good idea to review your bond terms regularly to ensure they still meet your needs.

Additionally, maintaining open communication with your bonding company can help you navigate compliance issues. They can provide valuable insights and support if you encounter challenges. Understanding the benefits of surety bonds can further enhance your business's ability to meet regulatory requirements effectively.

Conclusion

In conclusion, securing a Generic License & Permit Bond in Paris, Texas, is essential for your business to thrive. By understanding the importance of these bonds and following the necessary steps to obtain one, you'll not only comply with local regulations but also build trust with your clients. Remember to factor in the costs and stay on top of compliance to avoid common challenges. With the right approach, you can ensure a smooth operation and a successful venture.