If you're considering obtaining a TABC Performance-Beer Retailer's on-premise license (BE), understanding the $6,000 bond requirement is crucial for your business. This bond not only reflects your commitment to compliance but also safeguards your reputation in a competitive market. You might wonder about the specific steps you need to take to secure this bond and what implications it has for your operational practices. As you navigate through this process, knowing the potential consequences of non-compliance could significantly impact your approach to managing your establishment. What's the first thing you should do?

Understanding the BE Bond

When diving into the specifics of the BE Bond, you'll find it serves as a crucial component for beer retailers in Texas. This bond, typically set at $6,000, acts as a guarantee that you'll comply with state regulations regarding the sale of alcoholic beverages.

It's not just a formality; it's a legal requirement for obtaining your on-premise beer retailer's license. Alcohol bonds are essential for ensuring the legal operations of businesses in the liquor industry, providing a financial guarantee for adherence to regulations, thus protecting consumers and maintaining industry standards understanding liquor bonds.

By securing the BE Bond, you're essentially providing a financial safety net for the Texas Alcoholic Beverage Commission (TABC). If you violate any laws or regulations, the bond can be used to cover fines or penalties imposed on your business.

This means you're not only protecting the state's interests but also establishing your credibility as a responsible retailer.

You'll need to work with a surety company to obtain the bond, and they'll assess your business's financial health before issuing it. This process can take some time, so it's wise to start early in your licensing journey.

Understanding the BE Bond helps you navigate the complex landscape of beer retailing in Texas, ensuring you're well-prepared to meet all legal obligations.

Importance of Compliance

Compliance with state regulations is vital for any beer retailer looking to succeed in Texas. Not only does it ensure you're operating within the law, but it also protects your business from potential fines and penalties that can arise from non-compliance.

Ensuring that you have the necessary Wisconsin Surety Bonds can further solidify your commitment to regulatory standards. When you adhere to the Texas Alcoholic Beverage Commission (TABC) rules, you're building a reputation for your establishment as a responsible retailer, which can attract more customers.

You'll want to stay informed about local laws, including hours of operation, age restrictions, and serving limits. Compliance also extends to your employees; ensuring they're trained in responsible alcohol service can minimize risks and enhance your establishment's credibility.

Moreover, maintaining compliance fosters a safer environment for your patrons. By preventing over-serving and underage drinking, you contribute to the overall well-being of your community.

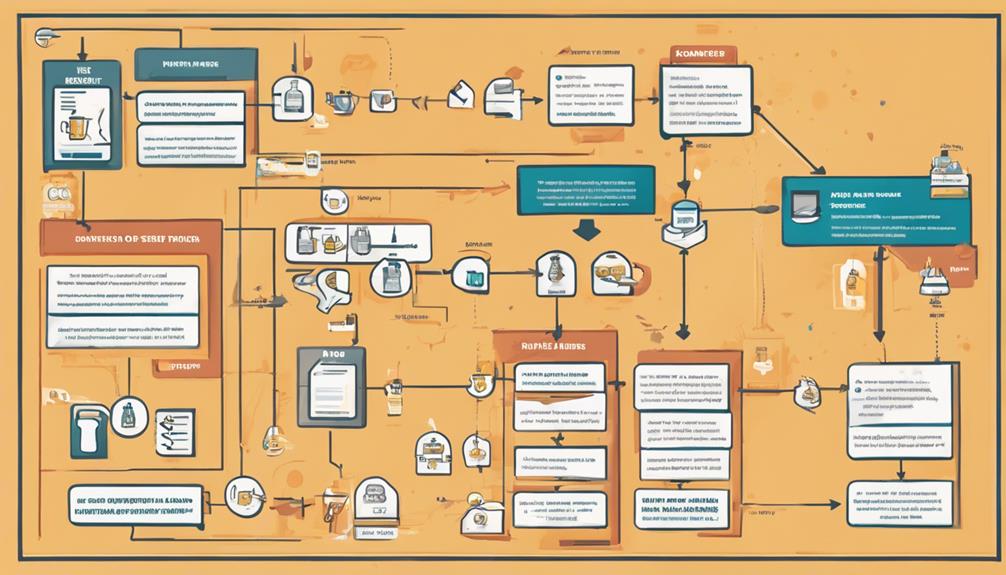

Application Process Overview

Navigating the application process for a beer retailer's license in Texas can seem daunting, but breaking it down into manageable steps makes it straightforward.

First, you'll need to gather the necessary documentation, which includes proof of ownership or lease for your establishment, a detailed floor plan, and your identification.

Next, complete the TABC application form, ensuring all sections are filled out accurately. Be prepared to provide information about your business structure, and any partners or investors involved.

Once you have your application ready, submit it along with the required fees to the Texas Alcoholic Beverage Commission (TABC).

After submission, TABC will conduct a background check, which may include contacting local law enforcement and verifying your business history. This process generally takes a few weeks, so patience is key.

You'll also want to check with local authorities for any additional permits or zoning requirements.

Financial Implications

Understanding the financial implications of obtaining a beer retailer's license in Texas is crucial for your business's success. First, you'll need to consider the upfront costs, including the $6,000 bond required for the license. This bond ensures that you comply with state regulations and can be a significant financial commitment, as it acts as a guarantee to protect the public from potential malpractice by your business.

Additionally, you should account for the ongoing costs associated with operating your business. These might include licensing fees, insurance, and potential renovations to meet local codes. Remember, these expenses can add up quickly, so it's essential to budget accordingly.

You'll also want to factor in the impact of sales taxes on your revenue. Texas imposes a sales tax on alcoholic beverages, which means you'll need to track your sales accurately and remit the appropriate amounts to the state. Failing to do so could result in penalties that affect your bottom line.

For more information on the types of bonds applicable to your business, refer to industry-specific applications.

Bond Amount and Requirements

When you apply for a beer retailer's license in Texas, securing a $6,000 bond is a key requirement. This bond acts as a financial guarantee to the Texas Alcoholic Beverage Commission (TABC) that you'll comply with state laws and regulations concerning the sale of alcohol. It protects consumers and the state by ensuring that you'll meet your obligations.

To obtain this bond, you'll need to work with a surety company that specializes in licensing bonds. The application process typically involves providing personal and business information, including your financial history. The surety will assess your creditworthiness, and your credit score can impact the premium you'll pay for the bond.

Keep in mind that the $6,000 bond amount reflects the maximum payout the surety company will cover in case of a claim against you. If you fail to adhere to the regulations, the bond can be called upon to cover any fines or damages.

Responsibilities of Retailers

As a beer retailer in Texas, you hold significant responsibilities that ensure compliance with state laws and protect your customers. First and foremost, you must verify the age of your customers. It's essential to check IDs diligently, as selling to minors can lead to severe penalties.

You also need to maintain your premises in a safe and clean condition. This not only creates a welcoming environment but also reduces the risk of accidents that could harm your patrons.

Training your staff on responsible alcohol service is crucial, as they play a key role in identifying intoxicated customers and refusing service when necessary.

Additionally, you're required to keep accurate records of your inventory and sales. This documentation helps ensure transparency and can be crucial during audits or inspections by the Texas Alcoholic Beverage Commission (TABC).

Moreover, you must adhere to local ordinances regarding operating hours and advertising practices. Being proactive in understanding these regulations will help you avoid potential pitfalls.

Ultimately, your commitment to these responsibilities fosters a responsible drinking culture and enhances the reputation of your establishment.

Consequences of Non-Compliance

Non-compliance with Texas alcohol laws can lead to serious consequences for your business. If you fail to adhere to regulations set by the Texas Alcoholic Beverage Commission (TABC), you risk facing hefty fines, license suspension, or even revocation of your on-premise license. This means you could be forced to close your doors, significantly impacting your revenue and reputation.

Additionally, you might be held liable for damages resulting from any illegal sales or activities. This could include civil lawsuits or criminal charges against you or your employees, leading to further financial strain.

The state may impose mandatory training for your staff, which can be both time-consuming and costly.

In some cases, repeated violations can lead to a more rigorous review of your business practices, increasing scrutiny from TABC. Such scrutiny can create a hostile environment for your operations, making it difficult to maintain a positive relationship with regulators.

Ultimately, your negligence can have ripple effects, affecting not just your business but also the community you serve. It's essential to prioritize compliance to ensure your establishment remains a trusted and lawful venue for patrons.

Tips for Maintaining Compliance

To ensure your business stays on the right side of Texas alcohol laws, it's crucial to implement a proactive compliance strategy.

Start by familiarizing yourself with the Texas Alcoholic Beverage Commission (TABC) regulations. Understanding the rules will help you avoid unintentional violations.

Next, keep accurate records of all transactions involving alcohol. This includes purchase invoices, sales receipts, and inventory logs. Regularly reviewing these documents will help you identify any discrepancies before they become major issues.

Training your staff on responsible alcohol service is another key step. Make sure they know the laws regarding age verification and responsible serving. Conduct regular training sessions to keep everyone updated on any changes.

Stay informed about upcoming legislative changes or TABC announcements. Subscribe to relevant newsletters or join industry associations to receive the latest updates.

Resources for Beer Retailers

Leveraging available resources can significantly enhance your operations as a beer retailer. First, tap into your local and state alcohol regulatory agencies. They often provide guidance, training programs, and updates on compliance requirements that can keep you ahead of the game.

Next, consider joining industry associations. These groups offer valuable networking opportunities, access to industry trends, and educational materials tailored to beer retailers. You can gain insights into best practices and connect with fellow retailers who share similar challenges.

Don't overlook online resources. Websites dedicated to the beer industry, such as the Brewers Association or the Texas Alcoholic Beverage Commission, provide a wealth of information, including legal updates, safety guidelines, and marketing tips.

Lastly, utilize social media platforms to engage with your customers and promote your offerings. It's a cost-effective way to create a loyal customer base while keeping your audience informed about events and promotions.

Conclusion

In conclusion, securing the TABC Performance-Beer Retailer's on-premise license bond is crucial for your business. It not only ensures compliance with Texas alcohol regulations but also protects your reputation and fosters a safe environment for your customers. By understanding your responsibilities and staying informed about compliance tips, you can avoid penalties and thrive in the industry. Remember, maintaining this bond demonstrates your commitment to responsible alcohol sales and strengthens your standing in the community.